As a Hampton Roads native, I grew up learning about our local market. This local expertise translates into an unmatched understanding of all the loan programs that can best benefit you in your journey to homeownership. My passion is to help my clients identify and reach their homeownership goals. Everyone's situation is unique, which I embrace in my approach to deliver an individually tailored solution to best suit your financial needs. Your relationship and satisfaction are far more valuable than any single transaction. I trust you will be delighted by my level of service so that I can help you attain your financial needs and desires throughout every stage of life. I'm always available and am just a phone call away. Please don't hesitate to reach out if you have any financing questions.

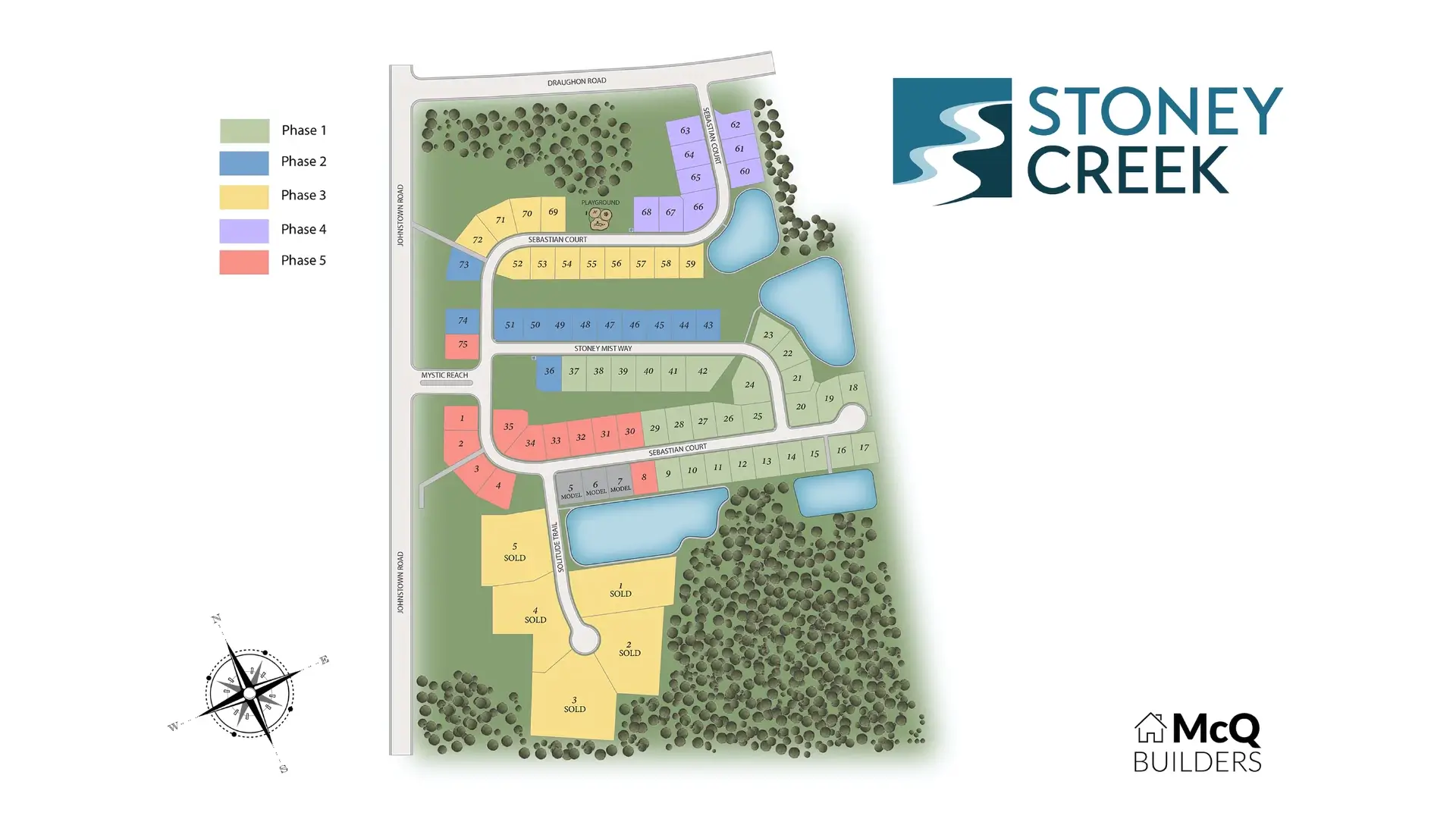

Escape the hustle and bustle of everyday life and unwind in the comfort of this peaceful enclave with water views, greenspace, and a park for the kids to play in. This exceptional community offers several semi-customizable floorplans to choose from with state-of-the-art features and an abundance of designer selected options to suit your personal taste and lifestyle. Stoney Creek is located in the highly desired Chesapeake school zone, making it an excellent choice for families with children. Additionally, Stoney Creek's cental location provides easy access to all of Hampton Roads highways, military bases, employers, shopping, dining, entertainment and outdoor activities.

Description:

Quickly start your path towards homeownership with our online loan application.

Description:

For a pre-qualification, the loan officer asks you a few questions and provides you with a pre-qualification letter. A pre-approval includes all the steps of a full approval, except for the appraisal and title search.

A rate lock is a contractual agreement between the lender and buyer. There are four components to a rate lock: loan program, interest rate, points, and the length of the lock.

Points are an upfront cash payment required by the lender as part of the charge for the loan, expressed as a percent of the loan amount. For example, "2 points" means a charge equal to 2% of the loan balance

Borrowers pay fees at closing for services provided by the lender and other parties, such as title companies. Lenders are required to provide a written estimate of these costs within 3 days of receiving a loan application.

Lenders require proof of income and assets, including bank statements, tax returns, W2 statements, and recent paystubs. More documents may be needed to show your down payment and ability to pay closing costs.

Your request has been submitted.