Jann Swanson, of Mortgage News Daily, recently reported that home buyers and sellers are not necessarily on the same page when it comes to the realities of today's housing market. Jann reports:

A recent survey by Redfin, the Seattle-based real estate company, found some substantial disconnects among buyers, sellers, and market reality. They are, the company said, not on the same page when it comes to the state of the housing market. While inventories have increased, buyers are still hesitating because of hurdles presented by affordability and access to credit. Sellers have been slow to acknowledge that the market is shifting away from them.

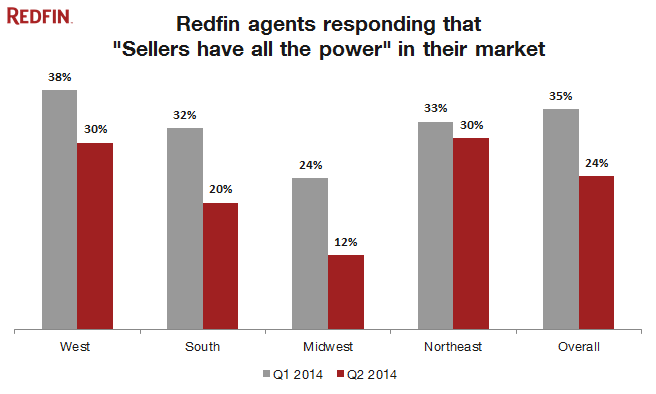

Redfin interviewed 707 of their agents and associates spread across 35 U.S. markets in late June about the attitudes and behaviors they see in their dual clientele. Just 24 percent of agents told the company that "sellers have all the power" in their markets, down from 35 percent three months ago. While the trend in the sentiment was similar nationwide, there were regional differences in the degree. In the upper Midwest only 12 percent of agents think sellers are in charge, half of the level in the first quarter of 2013. In the West and Northeast 30 percent of respondents said it was a sellers' market, down 8 and 3 percentage points respectively.

Redfin Chief Economist Nela Richardson said sellers appeared to have not yet grasped the change. "In May, 40 percent of sellers surveyed by Redfin said that they planned to list their homes above market value even though home sales had dropped by 9 percent since the year before." It does take time for sellers to adjust to prices changes, she said, but this latest shift is longer than the six to nine months that is typical. "Prices have moved down and then up so much over the past five years that it's even more difficult for sellers to have a realistic baseline for what their homes are worth in the current market."

Buyers on the other hand, she said, have shifted their mindset significantly since last year. "Buyers who have been searching for a long time may still try to win deals with aggressive offers. However, new buyers in the market are much less willing to chase an escalating sale price to compete with multiple bids. The demand side of real estate is moving from 'please take my offer' to 'take it or leave it as you please.' Homebuyers' willingness to walk away from a deal that's a bad fit is good for them and is ultimately healthier for the housing market."

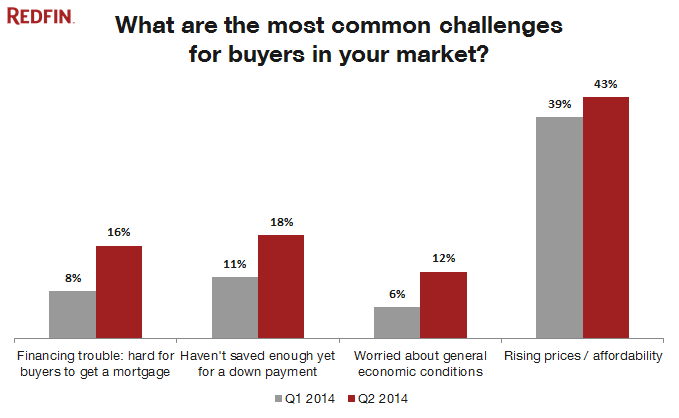

Inventories have been edging up in recent months and Redfin said this is overall good for buyers who are now less willing to jump into bidding wars. At the same time home prices and interest rates have been rising while access to credit remains tight - all of them factors that challenge buyers. Forty percent of Redfin agents said it was a good time to buy, but at the same time in 2013 these responses were at 46 percent.

Seventy six percent of agents said it was a good time to sell, down 10 points from the same time last year. The most common challenge for sellers according to 58 percent of respondents is the unrealistic expectations they hold about the value of their homes.

Many researchers seem to feel that young people born between the early1980s and the early 2000s, the so-called Millennial Generation, are the key to making or breaking the housing market so Redfin asked its agents to describe this group's homebuying approach. The words and phrases that came through repeatedly in the responses included "cautious," "tech-savvy" and "well-informed." Though responses varied, many said that millennial buyers were interested in homes with less maintenance, and were willing to sacrifice square footage to be closer to work and their friends.

Jann Swanson

Mortgage News Daily, Jul 9 2014, 11:36AM

http://www.mortgagenewsdaily.com/07092014_real_estate_sales.asp